If I Return a Game on Steam Can I Buy It Again?

If y'all're looking for a automobile buying rule, let me innovate you to the 1/10th dominion for car buying. The 1/10th rule volition help yous spend responsibly, reduce your car ownership stress, and boost your internet worth over time.

Back in 2009, I watched in horror as a total of 690,000 new vehicles averaging $24,000 each were sold under the Cash For Clunkers program.

The government's $4,000 rebate for trading in your car ended upwardly pain hundred of thousands of people'southward finances instead. With a median household income of just around $50,221 at the time, spending $24,000 on a new car was clearly too much.

Instead of buying a $24,000 car in 2009, you could accept invested the $24,000 in the Southward&P 500. If you did, you would at present accept virtually $100,000 in 2022. That's quite an opportunity cost for buying a new car!

Buying likewise much car is one of the easiest and biggest fiscal mistakes someone can make. Besides the purchase price of a car, yous've got to also pay car insurance, maintenance, parking tickets, and traffic tickets.

When you add everything upward, I'thou pretty sure you'll be shocked at how much information technology really costs to own a auto and bung. Later on more than 10 years, the ane/tenth rule for car buying has become the standard machine buying rule for financial freedom seekers everywhere.

The Car Buying Dominion To Follow: The ane/tenth Rule

The #one car buying rule to follow is my i/10th Rule for car buying. The rule states that you should spend no more than one/10th your gross annual income on the buy price of a car. The car can be new or old. It doesn't thing so long as the auto costs ten% of your annual gross income or less.

If you make the median per capita income of ~$42,000 a year, limit your vehicle purchase price to $iv,200. If your family earns the median household income of $68,000 a year, then limit your car purchase toll to $half dozen,800. Absolutely do not go and spend $39,950, the absurdly loftier median new car toll today!

If you absolutely desire to buy a car that costs $39,950, and then shoot to brand at least $399,500 a year in household income. You might belittle at the necessity to make such a high corporeality. However, information technology takes at least $300,000 a year to live a middle form lifestyle with a family today.

Minimize Your Fiscal Stress

If you actually desire to save for higher, save for retirement, have care of your parents, buy a dwelling, and not stress out about money when you lot're old, please keep your car purchase to at nearly ten% of your almanac gross income.

Once you purchase a motorcar following my 1/10th rule, ain your automobile for at least v years. Improve yet, shoot to ain information technology fo 10 years. Don't go selling your car every ii-3 years like nearly Americans exercise. If you lot exercise, y'all don't experience the full value of the car. Farther, you end upwardly paying wasteful sales taxes each time y'all buy a new or new used car.

Buying a car you cannot afford is the #one manner to financial mediocrity. Since Financial Samurai was founded in 2009, my goal is to help readers achieve financial freedom sooner, rather than afterwards. Ideally, I'd like every reader to attain an above average net worth for their age.

Financial independence is worth it. A car yous cannot comfortably beget is a bully headwind.

Why You Shouldn't Spend More than Than 10% Gross On A Car

Permit's go through specific reasons why yous should follow my ane/10th rule for car buying.

ane) Maintenance costs

The more you lot drive, the more you volition pay to maintain your vehicle. With thousands of parts per car, something volition inevitably break or need upgrading.

Non only do you have to pay for maintenance costs, you've besides got to pay for insurance, parking tickets, and traffic tickets. Further, the thrill of owning a new or new used car lasts for only several months. However, the pain of paying the same car payment lasts for years.

2) Opportunity cost

When yous buy a car you lose the opportunity of investing your money in assets that will probable grow and pay you dividends in the future. Everybody knows to save early and often to permit for the effects of compounding. Buying too much car is like negative compounding!

Imagine how much coin you would take accumulated if you invested $300-$500 a calendar month in the stock market since 2009 instead of paying for a motorcar?

3) More Stress

When you pay more than than i/10th your income for a car, yous volition become more than stressed. Yous'll feel stressed whenever you lot become a door ding later on parking your car at the local grocery store. Y'all'll get stressed whenever you incur wheel rash after parallel parking too shut to the curb.

Sometimes when you're driving in traffic, you'll experience more on edge because y'all don't want anybody dissentious your auto. If you are within 1/10th of your income, you lot drive and park stress free. You stop caring well-nigh door dings, bumper scrapes, even break ins. Stress kills folks.

4) Makes y'all want more

The nicer your automobile, the more you want to spend on other things. You starting time thinking stupid thoughts like: I've got to buy a matching chronometer sentinel, driving shoes, and outfit. Y'all starting time paying $twenty for valet because you want people to see you lot come out of your motorcar instead of park for free.

5) Makes y'all feel stupid

Deep down, you know that if you can't pay cash for your machine, yous can't afford the car. Each payment y'all brand is a reminder how foolish you lot are with your money. Why would you want to be reminded every single month of being dumb? The thrill of owning a nice machine fades after almost vi months. But the payment stays the same for years.

If Yous've Already Bought Likewise Much Car

Look, everybody makes dumb financial moves all the time. The important affair is to recognize your error, stop, and fix it! Here are some things you tin can do if you've bought too much car already.

1) Ain your auto until it becomes worth 10% of your income or less.

This is the simplest solution if you've spent too much. Bulldoze your auto for as long as possible until the market value is worth less than 10% of your gross annual income.

two) Bite the bullet and sell your car.

If you've spent anything more than than ane/5th your gross annual income on a car, I'd sell it. Information technology's making you lot poor. Even if you lot take to take a niggling fleck of a hit, I recall it'due south worth getting rid of your vehicle. Don't trade it into the dealer because y'all'll go railroaded. Instead, try negotiating via Craigslist.

3) Punish yourself.

Similar Silas does in The Da Vinci Code, whip yourself into submission! OK, maybe don't go to that farthermost. However, if you don't punish yourself, and so you will repeat your fault and feel fine with what yous have at present.

For the life of your car loan, take away a food you honey to consume such as chocolate. If yous are a coffee addict, swear never to drink that stuff again! Relieve more than of your income after taxes. Feel the squeeze and so that you realize how ridiculous your car spending is.

If the corporeality of money y'all're saving each calendar month doesn't hurt, y'all're not saving enough!

Recommended Cars Past Income (Tastes May Differ)

Cars congenital in the 1990s and beyond are and so much more reliable than those built prior. If you are serious about improving your finances, consider buying a motorcar with less options. The less electronics, the less electrical gremlins also. The more yous have loaded in your car, the more than maintenance headaches you lot volition have in the future.

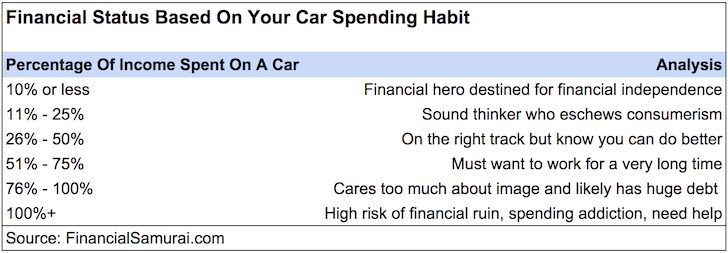

Below is the chart highlighting y'all financial status based on your machine spending as a per centum of household income. The closer you follow my ane/tenth rule for car buying, the closer you will get to financial independence.

Please annotation that in that location is NO SHAME in owning a car that'due south worth less than $10,000. I bought a 2d-hand State Rover Discovery 2 for $eight,000. And then I drove it for ten years until information technology was worth less than $2,000.

The car was great and loads of fun. With the coin saved from not buying a more expensive car, I diligently invested the coin. A decade later, the money grew by over 160%.

Put your ego aside so y'all can take true wealth: all the freedom in the globe. Your goal should be to generate enough passive income every bit possible so you don't take to work. Be a time millionaire or billionaire! Liberty is the true value of wealth.

The Pick For Great Wealth Is Yours

Care for the 1/tenth rule of car buying like a game. Y'all will be surprised to observe how many dissimilar type of cars you can buy with 1/10th your income if you make over $25,000 a year.

If you desire a $30,000 car, become motivated past the 1/10th rule to effigy out a way to make $300,000 a year. I way is to commencement a side hustle to generate more income on the side. We're all spending mode more time at home now. Might as well try to make some side income online.

If you lot tin't go motivated, then fine. Only don't think you can beget much more than. Retrieve well-nigh your time to come and the future of your family. A auto is simply there to take yous reliably from betoken A to point B.

If you lot're thinking about prestige and impressing others, don't be airheaded. Owning a nice property is way more impressive because at least you can potentially brand some money from the asset!

The Worst Philharmonic For Your Finances

1 of the worst fiscal combos is owning a car that you purchased for much more than than 1/10th your gross income and renting. You now have 2 of your largest expenses sucking money away from you lot every single month.

Remember most all the wealthy people you know or the millionaires side by side door. Chances are high the majority of them ain their homes and drive used cars. Their cars probable don't come close to 50% of their gross income.

If you lot want to achieve financial independence, follow my 1/10th automobile buying rule. Letting material things stress y'all out is no way to live.

If you want to detonate your finances and end up working longer than y'all want for the sake of a nicer ride, and then become alee and spend more than yous can comfortably afford. After all, we've just got i life to live.

Recommendations

one) Get affordable motorcar insurance

The best place to get affordable machine insurance is with Allstate. With Allstate, you're in good easily. Getting a quote is free and easy. Make sure you have the best car insurance possible to protect yourself and your family.

Every year, there are hundreds of thousands of accidents on the road. Yous need great motorcar insurance to protect your finances as well.

2) Track Your Cyberspace Worth Religiously

Hopefully you are now motivated to make more money to beget the motorcar of your dreams. Going into debt to buy a depreciating asset is unwise. Equally you grow your wealth through savings and investments, make sure y'all stay on top of your net worth.

Sign up for Personal Capital, the all-time complimentary fiscal tool on the web. I've been using them for gratis since 2012 and have seen my income and cyberspace worth skyrocket. The app keeps me motivated to spend smartly and invest wisely. There is no rewind button in life. All-time to get your fiscal life in order.

3) Invest In Real Estate To Build More Wealth

Instead of buying an overpriced machine, invest in existent estate to build more wealth. Real manor is a core asset course that has proven to build long-term wealth for Americans. Real estate is a tangible asset that provides utility and a steady stream of income if you own rental properties.

Accept a look at my ii favorite existent estate crowdfunding platforms. Both are complimentary to sign up and explore.

Fundrise: A way for accredited and non-accredited investors to diversify into existent manor through individual eREITs. Fundrise has been around since 2012 and has consistently generated steady returns, no matter what the stock market place is doing. For well-nigh people, it'southward better to invest in a diversified eREIT for exposure and risk direction.

CrowdStreet: A way for accredited investors to invest in individual real manor opportunities mostly in 18-60 minutes cities. 18-hour cities are secondary cities with lower valuations and college rental yields. Further, growth is potentially higher due to job growth and demographic trends. If yous accept a lot of capital, y'all tin build your own best-of-the-all-time real manor portfolio.

I've personally invested $810,000 in real estate crowdfunding to diversify my exposure and earn income 100% passively. As soon as you realize the opportunity toll of ownership a auto, you volition be more inclined to follow my car ownership rule.

The one/10th Rule For Auto Buying is a Financial Samurai original post.

Source: https://www.financialsamurai.com/the-110th-rule-for-car-buying-everyone-must-follow/

0 Response to "If I Return a Game on Steam Can I Buy It Again?"

Postar um comentário